Using affine GARCH models in dynamic portfolio optimization

While most research in financial market models is based on a continuous-time setting, the reliance on discrete data for calibration highlights the inherent need for discrete-time models for risk management and portfolio optimization. Affine GARCH models form a particularly interesting class in this regard, as they overcome the challenge of lacking closed-form solutions for pricing and optimization problems. After various affine GARCH models offering a broad range of different features were introduced for pricing purposes, there has been recent progress in the direction of dynamic portfolio optimization.

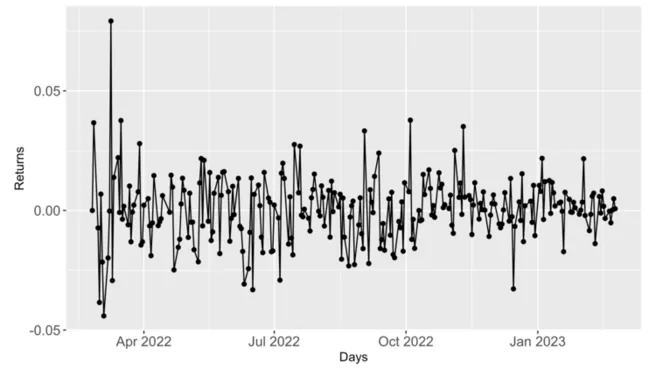

This talk aims to provide insight into the world of affine GARCH models, targeting the necessity of modeling stylized facts of asset returns. We will discuss recent related advancements in discrete-time portfolio optimization and look at open research questions.

TopMath-Talks

Im Rahmen der TopMath-Talks stellen Studierende und Promovierende des TopMath-Programms Teile ihrer Forschung vor. Sie geben einen verständlichen Einblick in ihr Interessensgebiet und ermöglichen es so Studierenden und Mitarbeitern, ihre mathematische Allgemeinbildung zu erweitern. Die Talks sind öffentlich und dauern ungefähr eine Stunde mit anschließender Diskussion. Jede*r ist willkommen.