Using affine GARCH models in dynamic portfolio optimization

While most research in financial market models is based on a continuous-time setting, the reliance on discrete data for calibration highlights the inherent need for discrete-time models for risk management and portfolio optimization. Affine GARCH models form a particularly interesting class in this regard, as they overcome the challenge of lacking closed-form solutions for pricing and optimization problems. After various affine GARCH models offering a broad range of different features were introduced for pricing purposes, there has been recent progress in the direction of dynamic portfolio optimization.

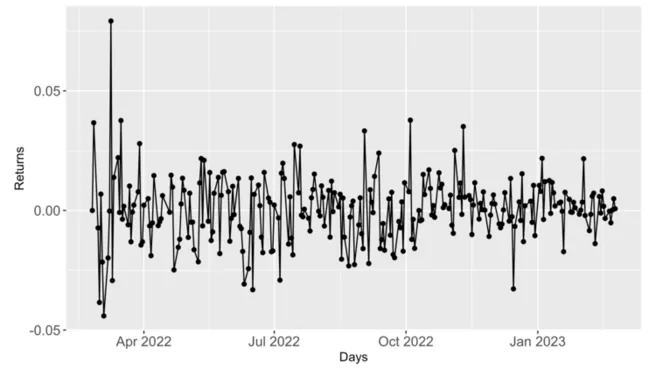

This talk aims to provide insight into the world of affine GARCH models, targeting the necessity of modeling stylized facts of asset returns. We will discuss recent related advancements in discrete-time portfolio optimization and look at open research questions.

TopMath Talks

As part of the TopMath talks, TopMath students and doctoral students present parts of their research. They provide an understandable insight into their current area of interest, enabling students and staff to broaden their mathematical background knowledge. The talks are open to the public and last about an hour, followed by discussion. You are cordially invited!